Contract Accounts Receivable (AR) FAQs

What is the Contract AR system

When should contract AR be entered into the Contract AR system?

How do I apply payments/revenue to contract AR?

How do I delete a contract AR?

How do I reduce a previously entered contract AR?

How do I increase a previously entered contract AR?

How do I correct contract AR that posted to the wrong contract and the cash has been applied?

How do I correct contract AR that is on the right contract, but revenue posted to the wrong FOP?

How do I change the transaction description on a contract AR?

What is the Contract AR system

The Contract AR system is system that allows departments to track the revenue that should be collected on an existing contract.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

When should contract AR be entered into the Contract AR system?

Contract AR should be entered when the revenue has been earned but not collected. This normally occurs at the time goods or services are provided and should coincide when the invoice is sent. Postponing the recording of contract AR until the payment is received is not encouraged.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I apply payments/revenue to contract AR?

Departments must use the Cash Receipt system to record the receipt of all cash, checks, wires, and credit card payments. When recording the receipt of contract AR in the Cash Receipts system, departments should select Contract from the Type drop down box in the Detail Line Information section of the cash receipt. Additional information on how to record contract AR in the Cash Receipt system is located in the Cash Receipts Information documentation. Once the cash receipt is processed the payment will be reflected against the respective contract number in the Contract AR system in the Cash Received column.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I delete a contract AR?

Only Accounting Services is able to delete contract AR. Send an email to Accounting Services with the following information:

- Contract number

- AR number

- Amount to delete

- The reason it needs to be deleted

- E.g. Contract has expired, AR was entered in error, the vendor will not pay, etc.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I reduce a previously entered contract AR?

Only Accounting Services is able to reduce the amount of a contract AR. Send an email to Accounting Services with the following information

- Contract number

- AR number

- Amount AR needs to be reduced

- The reason it needs to be reduced

- E.g. Wrong amount was entered, vendor has reduced amount, etc.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I increase a previously entered contract AR?

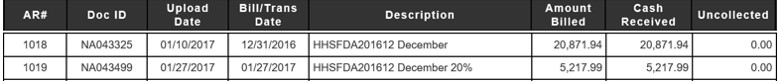

Departmental users are able to increase the amount of an existing contract AR by entering a new AR for the increase.

E.g.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I correct contract AR that posted to the wrong contract and the cash has been applied?

First, a new contract AR should be created on the correct contract.

Then the incorrect contract AR will need to be deleted. Only Accounting Services is able to delete contract AR. Send an email to Accounting Services with the following information:

- Incorrect contract #

- Incorrect contract A/R #

- Amount

- Correct contract #

- Correct contract A/R #

Accounting Services will reverse the incorrect posting and reapply the cash to the correct AR.

E.g. - Email to Accounting Services TTUHSC:

Please delete the entry on CON589981, AR #1001 for $1000, I applied the cash to the wrong contract.

Please apply the cash to CON589991 AR#1004.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I correct contract AR that is on the right contract, but revenue posted to the wrong FOP?

Departmental users should process a revenue transfer in the Financial Transaction System (FiTS) to move the revenue from the incorrect FOP to the correct FOP. Documentation should be attached to the FiTS request to validate the revenue belongs on the contract, otherwise the FiTS request will be returned.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

How do I change the transaction description on a contract AR?

Once a contract AR transaction has posted, the transaction description cannot be changed. It is not necessary to change the transaction description, however if you deem it important, this can be done by creating a new contract AR with the correct transaction description. The contract with the incorrect transaction description will need to be deleted. Send an email to Accounting Services with the following information

- Contract number

- AR number

- Amount of AR to be deleted

- Reason AR needs to be deleted

- E.g. The wrong month was referenced in the transaction description; The wrong vendor was referenced in the transaction description; etc.

Questions?

Email Accounting Services at hscacc@ttuhsc.edu.

Contact

Accounting Services

-

Address:

3601 4th Street STOP 6274 | Lubbock, Texas 79430-6209 -

Phone:

806.743.7826 -

Email:

hscacc@ttuhsc.edu