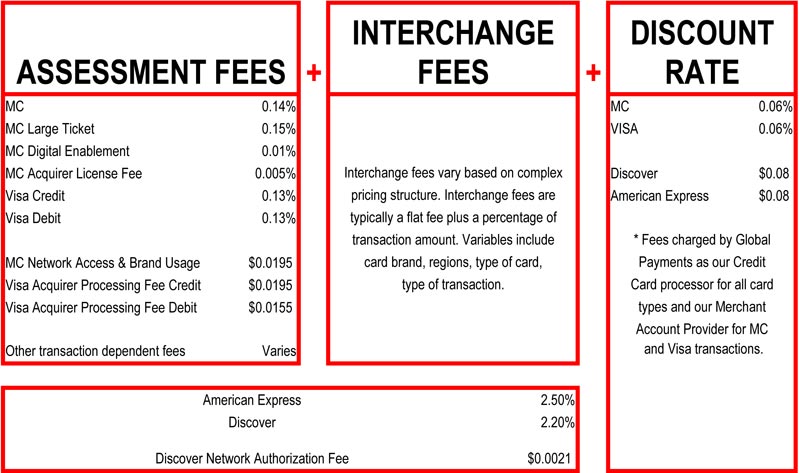

Credit Card Fees

Credit card fees are made up of assessment fees, interchange fees, and discount rates, and charged to TTUHSC departments, in lump sum, one month in arrears. Due to continuous updating of fees by credit card networks, a current list of fees cannot be maintained. The above table is for reference and intended to provide users with a general understanding of the fee structure associated with credit card acceptance.

- Assessment Fees are determined by the credit card issuing banks and credit card issuing associations (MC, Visa, etc.) and should be consistent regardless of credit card processor or merchant account provider. Assessments are typically based on a percentage of the total transaction volume. Also included are card brand fees based on number of transactions.

- Interchange Fees are determined by the credit card issuing banks and credit card issuing associations (MC, Visa, etc.) and should be consistent regardless of credit card processor or merchant account provider. These fees have a complex pricing structure, which is based on the card brand, regions or jurisdictions, the type of credit or debit card, the type and size of the accepting merchant, and the type of transaction (e.g. online, in-store, phone order, whether the card is present for the transaction, etc.). Further complicating the rate schedules, interchange fees are typically a flat fee plus a percentage of the total purchase price (including taxes).

Interchange rates are established at differing levels for a variety of reasons. For example, a premium credit card that offers rewards generally will have a higher interchange rate than do standard cards. Transactions made with credit cards generally have higher rates than those with signature debit cards, whose rates are in turn typically higher than PIN debit card transactions. Sales that are not conducted in person, such as by phone or on the Internet, generally are subject to higher interchange rates, than are transactions on cards presented in person.

For one example of how interchange might function, imagine a consumer making a $100 purchase with a credit card. For that $100 item, assume the retailer would get approximately $98. The remaining $2, known as the merchant discount and fees, gets divided up. About $1.79 would go to the card issuing bank (defined as interchange), $0.15 would go to Visa or MasterCard association (defined as assessments), and the remaining $0.06 would go to the retailer's merchant account provider (defined as discount fees).

- Discount Rates are fees charged by credit card processors or merchant account providers for their services in processing credit card transactions.

- Credit Card Processors (i.e., Global Payments): Also known as Acquiring Banks aka Acquirers, these institutions act as messengers between merchants and credit card associations. They pass batch information and authorization requests along so that merchants can complete transactions in their businesses. A merchant may encounter several acquirers for one transaction - one that creates monthly statements, one that handles technical support, and one that issues money to a bank account.

- Merchant Account Providers: These are companies that manage credit card processing (e.g. sales, support, etc.), usually through the help of an acquirer. They could be financial institutions, independent sales organizations, or double-duty acquirers, depending on the situation.

Contact

Accounting Services

-

Address:

3601 4th Street STOP 6274 | Lubbock, Texas 79430-6209 -

Phone:

806.743.7826 -

Email:

hscacc@ttuhsc.edu